By Andre Theron – Co-founder and CTO, Coin Afriq (Pty) Ltd

Cryptocurrency has taken the world by storm. Since the launch of Bitcoin in 2009, not only has a new decentralized form of digital payment sprung into existence, it has also spawned an entire industry – with new cryptocurrencies, blockchains and technologies being built upon it.

This is staggering when you consider that at the time of launching Bitcoin was worth no real-world monetary value. Presently in 2025, 1 BTC (Bitcoin) is worth roughly R1.865M (roughly $103K in US Dollars). The current Cryptocurrency Market Cap is $3.43T, which grew by 39.4% since last year.

In this article, we’ll be specifically looking at the cryptocurrency market in Africa, as well as its pitfalls, potential and how it relates to the Coin Afriq project – a new Pan-African cryptocurrency and blockchain that is affordable, highly secure, next-gen and more fair, democratic and decentralized.

The Cryptocurrency Market in Africa

Despite vast wealth inequality, inflation, corruption and conflict, or perhaps because of it, Africa is one of the quickest growing cryptocurrency markets in the world.

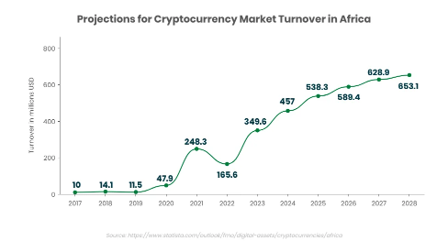

Based on the latest projections from Statista, the revenue from cryptocurrency in Africa is expected to reach $2.9B this year, with a yearly growth rate of 4.8%.

The number of users is expected to reach 53.89M users this year and user penetration rate is expected to increase 4.05%. The biggest drivers in cryptocurrency adoption on the African continent are South Africa and Nigeria, with both leading the way in terms of user engagement and regulatory frameworks. South Africa specifically had a 38% crypto growth in 2024 as per TechPression.

The top cited reasons by users in Africa for adopting cryptocurrency are:

- Economic Instability and Inflation: Many African countries experience economic instability and high inflation. Cryptocurrencies like Bitcoin and stablecoins, can serve as a hedge against inflation and currency devaluation.

- Limited Access to Banking: A significant portion of the African population lack access to traditional banking. Cryptocurrencies offer an alternative for financial inclusion, especially in rural areas.

- Cross-Border Remittances: Cross-border remittances are a major source of income for many African families. Cryptocurrencies offer a faster, cheaper and more efficient way to send money across borders.

- Young, Tech-Savvy Population: Africa has a large young tech-savvy population that is embracing digital technologies like cryptocurrency.

- Mobile Penetration: Africa has high mobile phone penetration rates, making it easier for people to access the internet. High mobile penetration has enabled Africa to leapfrog many develop countries in adopting digital finance.

- DeFI and Blockchain Technology: The growth of Decentralized Finance (DeFi) and Blockchain technology is also contributing to the rise of cryptocurrencies in Africa. DeFi platforms offer an easy way to lend, borrow and trade, services not available easily through traditional finance.

With the above information and the growth rate, it’s no surprise that the cryptocurrency industry has grown in Africa. However, there are also significant problems with current cryptocurrencies, whether Bitcoin, Ethereum, stablecoins or AltCoins.

Cryptocurrency Price and Wealth Inequality

One of the biggest hurdles in further adoption of cryptocurrency in Africa is the vast wealth inequality. The richest 10% of Africans hold a disproportionate share of the wealth, while the poorest half possess only a small fraction, often less than 1%. In South Africa, one of the highest developed countries in Africa, the World Bank’s Gini index places South Africa as the most unequal country globally.

The other main hurdle is the price of leading cryptocurrencies.

As mentioned earlier, 1 BTC is worth around R1.865M (around $103K).

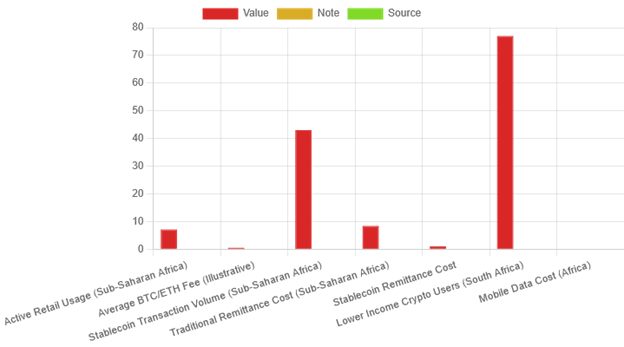

The second largest cryptocurrency called Ether (on the Ethereum network) is worth roughly R47.2K ($2621.01). In South Africa, one of most developed countries in Africa, the average monthly salary is around R28 321.00 as of Q4 2024. The median monthly salary is approximately R27 200.00, meaning half of all workers earn more than this amount, while the other half earn less.

While not directly related, the unemployment in South Africa is 32.9%, with 46.1% for the youth of the country. This lack of income with the low levels of payment from welfare means that a significant portion of the country do not have a great amount of purchasing power and cannot fully participate in the economy.

Based on the above metrics, it is beyond the purchasing power of the average person in South Africa, let alone other African countries, to amass a good amount of Bitcoin or Ether.

Bitcoin requires highly expensive equipment to mine (using their Proof of Work consensus) that is environmentally hazardous, affecting our already strained power grid. Ethereum requires at least 32 ETH for staking on your own validator node (using their Proof of Stake consensus).

It could be argued that pooled staking, liquid staking or staking as a service could be use, but these platforms are often highly centralized and only offer a very small reward to the pool, unless they have significant ETH.

A popular alternative has been stablecoins – a type of cryptocurrency where the value of the digital asset is pegged against a reference asset, which can be fiat currency, traded commodities or another cryptocurrency. Stablecoin adoption has grown in Africa tremendously. Circa September 2024, EMURGO Africa reported that the stablecoin volume hit more than $30B, which is 50% of the total crypto volume attributed to Africa between June 2022 and July 2023.

Most of these stablecoins are pegged against a fiat currency – specifically the US Dollar.

While this of course does give it real-world backing, it also in turn acts as a middle-man between the user and the fiat currency, somewhat defeating the concept of crypto as an alternative to fiat currency. Notably, if the US Dollar for some reason were to devalue, the value of the cryptocurrency will similarly drop. While it is more stable than many other types of cryptocurrencies, it is still volatile due to the aforementioned reasons.

However, there are real-world assets that aren’t fiat that Africa is vastly rich in.

The Gold Standard

Most currencies today are pegged largely to their exchange rate to the US Dollar, the Dollar being the best-known fiat currency in the world. However, the Dollar wasn’t always a fiat currency.

Before 1971, the US Dollar was part of the Bretton Woods system.

It was convertible to gold at a fixed price, and most other currencies were pegged to the US Dollar. This changed in 1971 when President Richard Nixon decided that the US Dollar would be no longer be backed by a physical commodity like gold, but by government decree and trust in its value. This was referred to as the “Nixon Shock”, which had a global impact, as the US Dollar was the reserve currency for many countries, leading to worldwide adoption of fiat currencies.

The big problem with fiat currencies is that it gives central banks greater control over the economy, because they can control how much is printed. While in ideal conditions, this is done responsibly, governments could also print too much of it, resulting in hyperinflation (which happened in both Weimar era Germany and Zimbabwe). A government could also have incentive to devalue a currency to pay for spending.

Where Africa fits in

Africa is rich in natural resources and commodities. In reference specifically to gold, in 2021 Africa produced 680.3 metric tons of gold, accounting for nearly a quarter of global gold mine production. South Africa, despite having diminishing production, still holds an estimated 6000 tons of gold, the second-largest reserve-base globally. Other African countries like Algeria, Egypt, Libya, Ghana, Mali and Zimbabwe also have large reserves.

Africa is truly rich in gold – so why aren’t we using this to peg cryptocurrency?

A gold backed cryptocurrency would be far less volatile than traditional cryptocurrencies and its value fluctuates less than fiat currency. Africa has the mineral wealth to truly claim its stake in the digital economy if we stake a cryptocurrency against gold – hence our idea: A Pan-African cryptocurrency that will be pegged against gold.

The Coin Afriq Project

Coin Afriq was borne out of the idea that there needs to be a modern, secure Pan-African cryptocurrency with low barriers for entry so that ordinary people on the African continent could truly participate in the economy.

I was approached by the Founder and CEO of Coin Afriq, Mr. Hannes Uys, with the idea of a new cryptocurrency that could be used across Africa and actually be affordable so that ordinary people could participate – not just those with wealth, and not exclusively to those who are tech-savvy. Thus began the journey.

Mr. Uys has 30+ experience in the gold industry – specifically starting gold mines and acting as CEO for many companies across the EMEA and ASEAN regions. We both saw the advantage of eventually pegging our new cryptocurrency and blockchain to gold.

As a developer and ardent researchers, I decided to see if we can’t find a way to create this new blockchain as a more fair, democratic and decentralized system – values in line with the original vision of cryptocurrency.

We engaged in talks with various players in the crypto industry – both consumers and founders, on what they thought a new cryptocurrency should do, along with technical ideas I had formulated and the vision of our Founder.

Architecturally the decision was reached that this cryptocurrency should have the most fair and democratic system possible. As Co-Founder and in charge of the technology stack, I knew this had to be a Nominated Proof of Stake system.

Nominated Proof of Stake (NPoS) doesn’t only take into regard how much coin you already possess, but lets nominators elect their validators and base it on their merits, after which an algorithm ensures random distribution to ensure no undue centralization can occur.

By consulting with the crypto community, we heard their feedback and implemented features such as:

- Post Quantum Cryptography

- ISO20022 Support

- High Interoperability with Other Networks

- Smart Contracts

- Support for Decentralized Finance, Decentralized Applications and Derivative Tokens

A secure language would be needed that could be extensible, but easy for developers to learn.

Ethereum created Solidity for this task – I decided the logical decision would be Rust.

As Rust is a highly performant, secure and typesafe language that is favoured by many developers, this would mean easy adoption. My search also led me to a framework which uses Rust, has high interoperability, and has Smart Contract capabilities rolled-in – Hyperledger Iroha2.

A challenge was: how could we get ordinary people to start using cryptocurrency?

Our answer was to build not only the cryptocurrency and blockchain, but also a suite of applications.

Coin Afriq Website and Imali Wallet

We settled on the idea of having the capability for users to buy, sell, trade and stake on our website and to develop a dedicated non-custodial wallet called the Imali Digital Wallet with these same features that could be published for both mobile (Android and iOS) and desktop (Linux, macOS and Windows).

By utilizing free and open-source software for both the web (NextJS, WordPress, APIs) and mobile (Tauri v2, APIs), we could effectively do the above and significantly reduce development time.

A very ambitious goal and project, the key question being: is it financially feasible?

Economic Feasibility of Coin Afriq

We decided to carefully work out the tokenomics of Coin Afriq (CAFQ ticker).

We settled on the low initial price of R10.00 per coin at launch, with pre-sale at R6.80 and Initial Coin Offering (ICO) at R8.50 per coin.

Engaging with a dedicated listing agency, market maker and crypto marketing agency, we had a solid plan. We decided to conservatively map out the data:

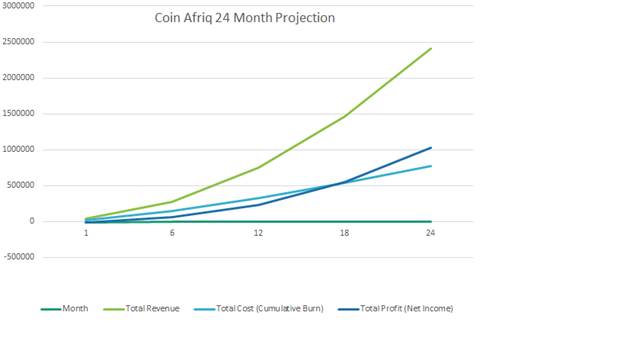

In this 24-month projection, we calculated the data as follows:

- Total Addressable Market (TAM) – $2.9B

- Serviceable Addressable Market (SAM) – $17.4M

- Serviceable Obtainable Market (SOM) – $1.74M

At a calculation of our SAM being 0.6% of the TAM – a very conservative figure, and capturing a SOM of 10% of the SAM based on cohort analysis, the figures clearly indicated a massive potential within 24-months not just for investors and the company, but also a significant impact on the cryptomarket, particularly in South Africa – a key player in crypto in Africa.

This all was calculated as only from constant income i.e without the sales from pre-sales, ICO or airdrops.

This also showed us based on cohort analysis that we could have a comfortable Long-Term Value (LTV) of roughly $64.80 and Cost of Acquiring Customer (CAC) at roughly $16.20 calculated per user over 24-months. This shows an LTV to CAC ratio of 4:1, which is considered a great investment.

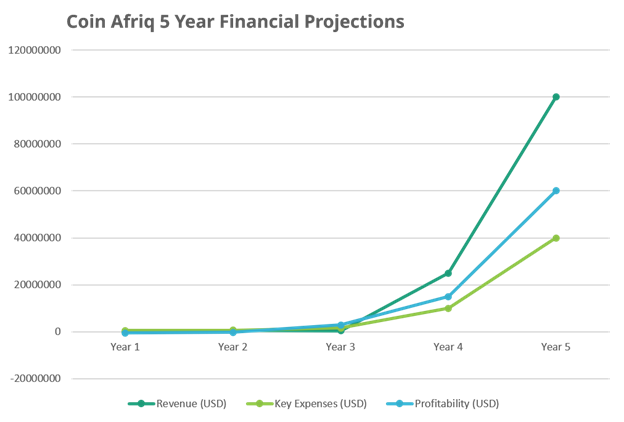

We see even greater potential when we look at a 5-year financial projection based on the project data and factoring our milestones and roadmap.

This is a staggering $60M Annual Recurring Revenue (ARR) by solely following our business plan and carefully following our roadmap and milestones. This figure could even be higher when factoring in the gold peg, expansion across Africa and the minting of more coins from our soft total supply of 10M CAFQ.

We based these figures according to these reliable defensible assumptions:

- Phased African Expansion: Focused market entry reduces risk, optimizes learning.

- Gold Peg = Trust & Adoption: Unique stability drives user growth in Africa.

- Growing African Digital Payments: Large, expanding target market.

- Network Effects Fuel Growth: Increased user base enhances platform value.

- Lean & Scalable Operations: Efficient tech enables cost-effective growth.

- Ecosystem Monetization: dApps/DeFi provide additional revenue streams.

- Realistic Market Share: Conservative projections with significant upside.

- Data-Driven Optimization: Continuous learning informs strategy.

With these figures, data and key-points, we can iterate our roadmap as follows:

Phase 1: Foundation & MVP Development (Currently in Progress)

Key Objectives:

- Finalize core blockchain architecture leveraging Rust and HyperLedger Iroha2.

- Complete development and internal testing of the Minimum Viable Product (MVP) showcasing:

- Core transaction functionality with CAFQ.

- Implementation of post-quantum cryptography (ML-KEM and ED25519).

- Demonstration of Byzantine Fault Tolerance.

- Basic wallet functionality.

- Initial showcase of smart contract capabilities.

- Establish core team and operational infrastructure.

- Secure strategic early partnerships.

Phase 2: Pre-Sale & Community Building

- Key Objectives:

- Launch and execute the pre-sale event for early supporters and strategic investors (10% of total CAFQ supply at R6.80 per CAFQ).

- Actively engage and grow the Coin Afriq community through dedicated channels.

- Expand marketing and awareness campaigns.

- Finalize legal and regulatory frameworks for initial launch.

- Secure initial partnerships for ecosystem integration.

Phase 3: ICO & Mainnet Launch (South Africa Focus)

- Key Objectives:

- Conduct the Initial Coin Offering (ICO) for the wider public (up to 15% of total CAFQ supply at R8.50 per CAFQ).

- Successfully launch the Coin Afriq Mainnet.

- List CAFQ on a Tier 2 Centralized Exchange (CEX) with a dedicated market maker focused on liquidity.

- Drive initial user adoption and transaction volume within South Africa.

- Onboard early dApps and DeFi projects to the platform.

- Implement the initial network transaction fee structure (0.5% with burn mechanism).

Phase 4: Building Towards Gold Pegging

- Key Objectives:

- Focus on generating sustainable revenue from network operations within the South African market.

- Strategically explore and establish partnerships within the mining sector, leveraging the founder’s expertise, to secure consistent access to gold resources.

- Research and develop the specific mechanism for pegging the value of CAFQ to gold (direct backing, stablecoin model, etc.), prioritizing security and transparency.

- Begin accumulating initial gold reserves based on operational profits and strategic acquisitions.

- Develop transparent and auditable systems for managing and verifying gold reserves.

Phase 5: Gold Peg Implementation & Initial African Expansion

- Key Objectives:

- Officially implement the gold-pegging mechanism for CAFQ, communicating the details and benefits to the community and potential users.

- Initiate strategic expansion into 2-3 key neighboring African markets, leveraging the enhanced trust and stability offered by the gold peg.

- Focus on early user acquisition and establishing use cases within these initial expansion regions.

- Continue growing the developer community and the number of dApps and DeFi solutions on the platform, highlighting the stability of CAFQ.

Phase 6: Broader Pan-African Expansion & Advanced Features

- Key Objectives:

- Broader expansion across the African continent, adapting strategies for diverse markets, now with the added advantage of a gold-backed currency.

- Focus on large-scale partnerships with businesses, financial institutions, and potentially governments, emphasizing the stability and store-of-value proposition.

- Implement advanced features such as derivative token support and enhanced interoperability.

- Evaluate and potentially pursue listing on Tier 1 Centralized Exchanges, leveraging the credibility of the gold peg.

- Further refine and optimize the network fee structure and burn mechanism based on usage and community feedback.

The result of this plan would not only be a disruptive technology in terms of cryptocurrency and blockchain, especially on the African continent, but also a rich ecosystem that’s extensible, scalable and robust.

Conclusion

Coin Afriq offers a breakthrough technology based on sound financial data, next-generation technology and humanistic values such as fairness, equality, democracy and decentralization.

We are excited to share more of our project as it develops.

If you want to know more, feel free to email us info@coinafriq.org

We are also actively looking for investors to launch this groundbreaking project.

Share this article as much as you like, spread the word.

We want as many people to participate as possible so we can build a Coin for Africa – made by people in Africa for Africa!